- Cleveland Real Estate Investors

- Posts

- 🏘️ New BRRRR Deal Just Hit the Market

🏘️ New BRRRR Deal Just Hit the Market

📉 Undervalued Properties You Can Bid On

Good morning, Cleveland Real Estate Investors!

Joke: What’s a real estate investor’s favorite season?

👉 BRRRR—because it’s always time to buy, rehab, rent, refinance, and repeat! ❄️🏠

Don’t keep us a secret: Share the email with friends (copy URL here)

📬 In today’s edition:

💰 Turnkey Rental with Instant Cash Flow

📉 Prices Cooling? Here's the Data

💼 Master the BRRRR Game

By Tyler Finkler - Local Realtor & Appraiser

📰 Cleveland Market Minute

‘It really is bizarre’: Reserve Square in downtown Cleveland will be foreclosed on; owner blames Trump

CLEVELAND, Ohio — Downtown Cleveland’s largest mixed-use building will be foreclosed on soon, the result of President Donald Trump’s policies, the building’s owner said Thursday.

Price blamed the Trump administration’s policies against immigrants, particularly against student visa holders and hospital employees on work permits, who made up a large portion of Reserve Square’s tenants.

See Cuyahoga County home sales, other property transfer details for June

CLEVELAND, Ohio - The cleveland.com database of home sales and other property transfer details has been updated with transactions for June 2025.

The database is updated each month. Since home prices sky-rocketed so sharply in the last few years, it can be used as a tool for comparison to previous years by searching a particular street or city.

Cleveland names four finalists to build modular homes

The city of Cleveland has selected four manufacturers as finalists in its major modular home initiative.

Why it matters: Modular homes, which can be constructed quickly and affordably in a factory setting and then assembled on site, are being embraced as a solution to the city's multi-billion dollar housing crisis.

866 Beechers Brook Rd, Mayfield Village, OH 44143

💰 Sale Price: $365,000 (Sold July 28, 2025)

📏 Size: 4 beds | 🛁 2 baths | 2,264 sqft

🌳 Lot Size: 34,582 sq ft (0.79 acres)

🛠️ Year Built: 1983

🚗 Garage: 3-car attached garage

🔥 Fireplaces: 2

📝 Investor Takeaway

This 2,264 sq ft Colonial in peaceful Mayfield Village just closed at $365K, or $161 per square foot—a fair value for the area, especially on a nearly 0.8-acre wooded lot with creek views. Built in 1983, this two-story home offers a spacious layout with 4 bedrooms (including 1 on the main level), 2 full baths, and a finished basement.

Standout features include central air, a mix of steam and baseboard heating, laundry on the main level, and three garage bays with direct access. This home’s size, layout, and prime suburban setting make it a great fit for owner-occupants, with additional appeal for investors targeting family-oriented rentals or long-term equity holds in the Mayfield CSD.

🏡 Neighborhood Insight

📍 Subdivision: Mayfield 02

🏫 School District: Mayfield CSD - 1819

🧾 Assessed Taxes: ~$7,381 annually

💸 No HOA fees

📈 Recent Sales Nearby:

875 Beechers Brook Rd: $388,000 | 4 bed | 3 bath | 2,450 sqft

844 Derby Dr: $405,000 | 5 bed | 3 bath | 2,600 sqft

900 Wilson Mills Rd: $365,500 | 3 bed | 2.5 bath | 2,230 sqft

📌 Notable Features

4 bedrooms with main-floor option

Finished basement for added living space

2 fireplaces

Creek/stream views

3-car attached garage

Stone + vinyl siding exterior

Located in quiet, tree-lined residential pocket with excellent school access

💡 Insider’s Insight

💰 Grow Wealth with the BRRRR Method

Buy. Rehab. Rent. Refinance. Repeat.

Want to scale your real estate portfolio faster without tying up your cash? The BRRRR strategy is your playbook. Here's how it works—and how you can apply it at any price point.

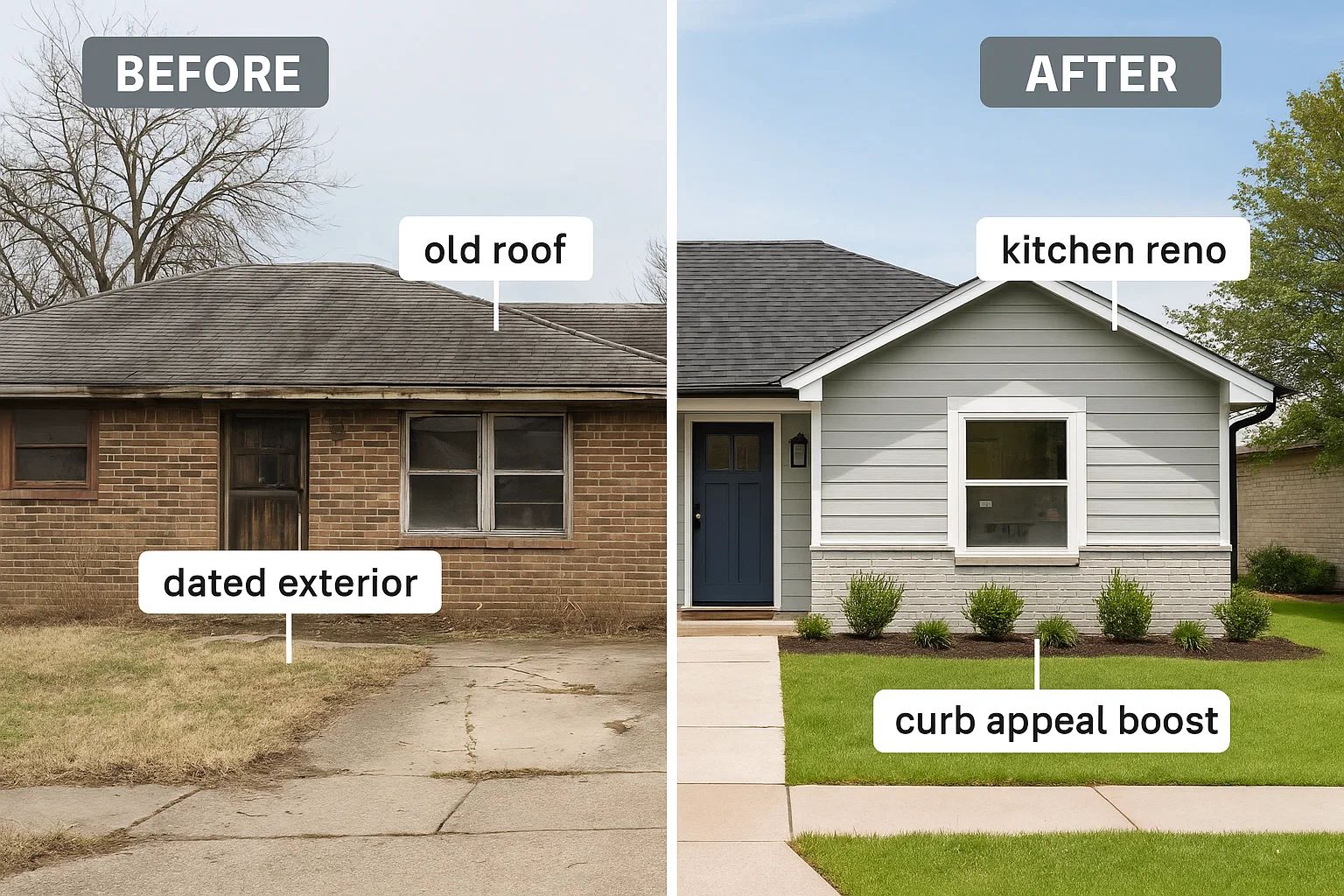

🔁 What Is the BRRRR Method?

Buy a distressed or undervalued property using cash or short-term financing

Rehab to boost its value and marketability

Rent it out to reliable tenants at market or premium rates

Refinance with long-term financing based on the new appraised value

Repeat the process using your cashed-out equity

💡 Why It Works

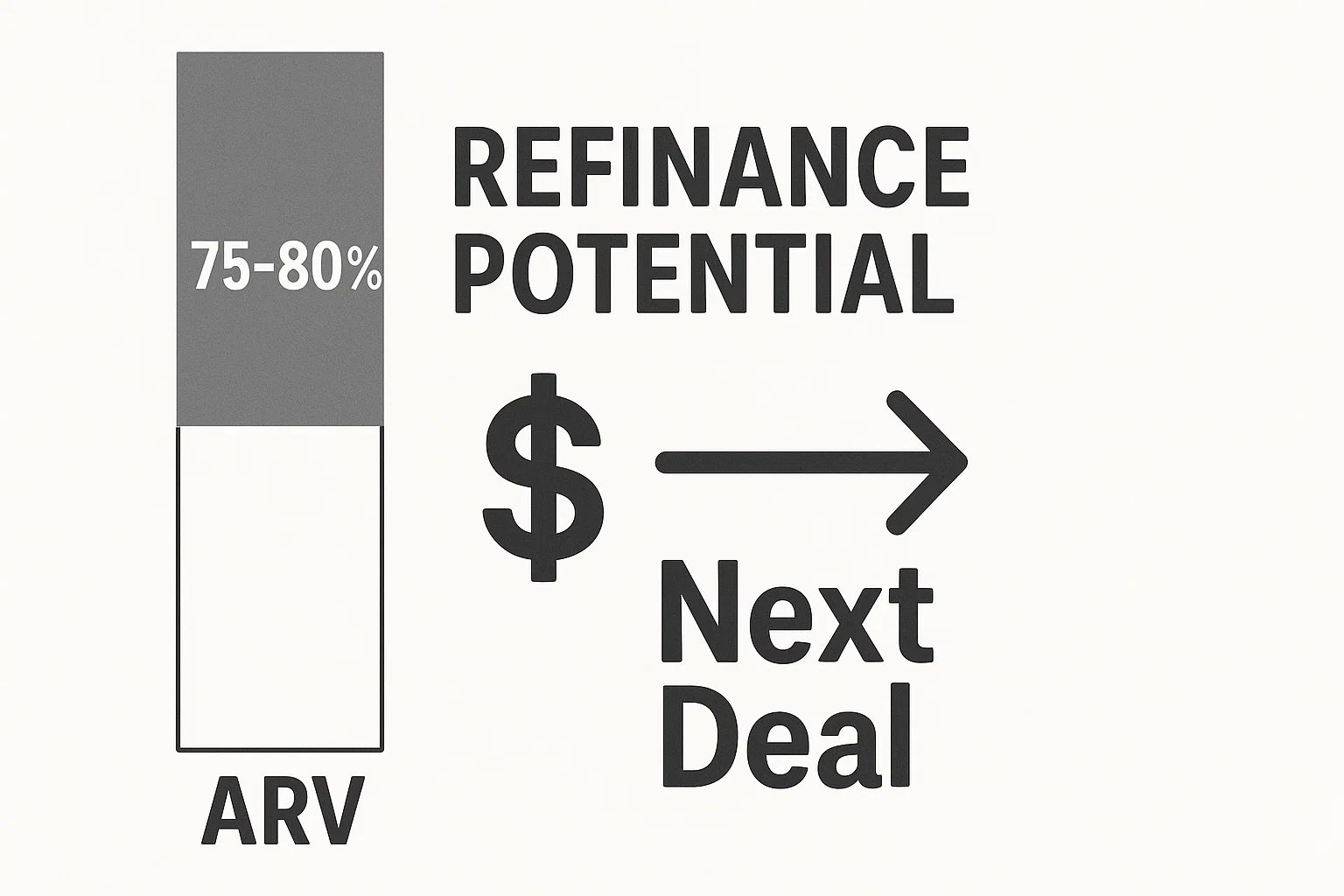

Through a cash-out refinance, you can recoup up to 75–80% of the property’s After Repair Value (ARV). That means potentially getting back all of your initial investment—and using it to fund the next deal.

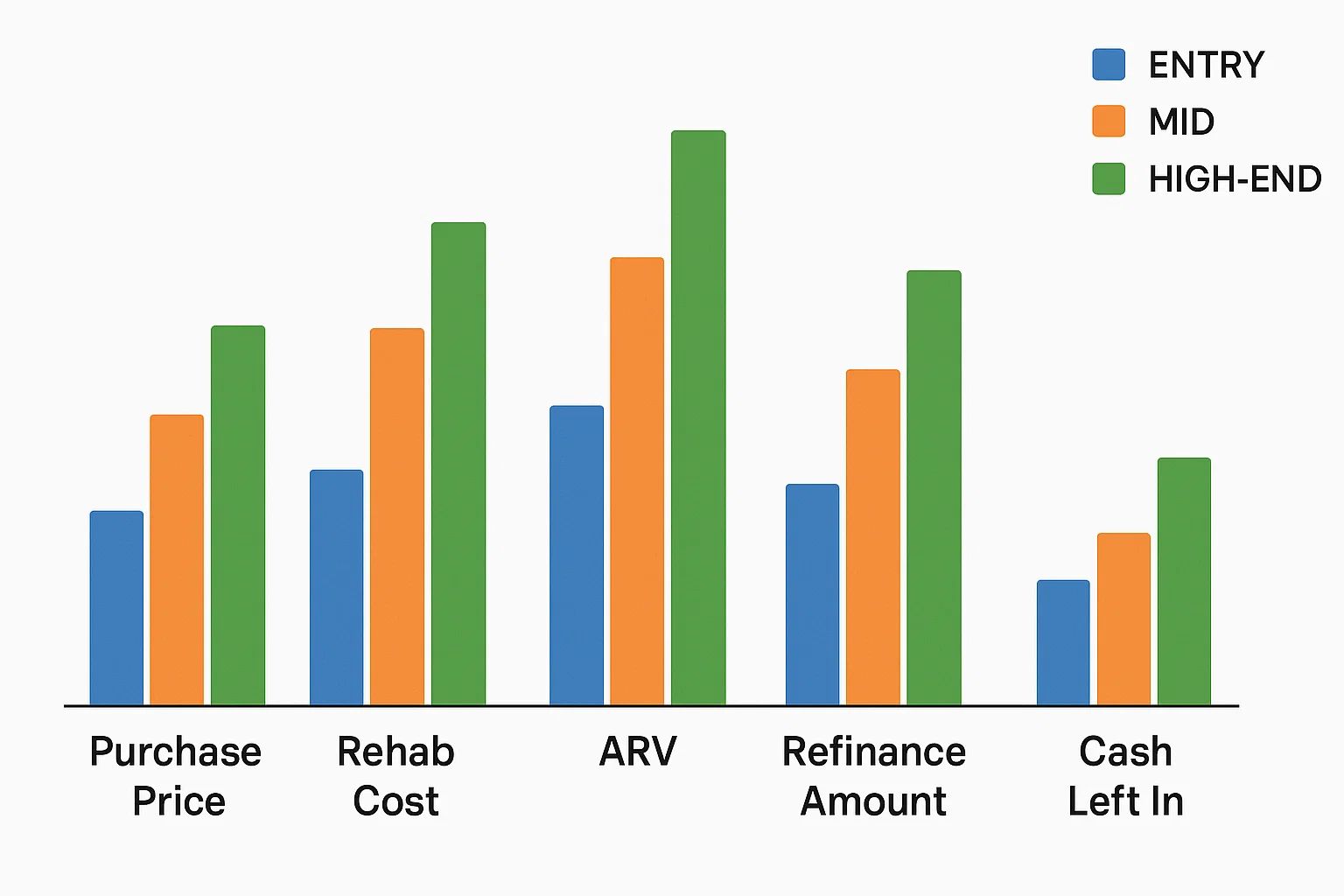

📊 BRRRR in Action: Sample Deal Scenarios

Scenario | Purchase Price | Rehab Cost | Total In | ARV | Cash-Out % | Cash-Out Amt | Cash Left In |

|---|---|---|---|---|---|---|---|

Entry-Level BRRRR | $70,000 | $25,000 | $95,000 | $130,000 | 75% | $97,500 | $0 |

Mid-Range Deal | $150,000 | $40,000 | $190,000 | $240,000 | 75% | $180,000 | $10,000 |

Higher-End BRRRR | $250,000 | $50,000 | $300,000 | $375,000 | 75% | $281,250 | $18,750 |

Appreciation Play 💥 | $200,000 | $30,000 | $230,000 | $320,000 | 80% | $256,000 | $0 + profit |

📈 Key Takeaways

ARV matters—higher values mean higher leverage.

Rehab discipline is essential—stick to the budget.

Cash recovery = scaling power. The less you leave in, the faster you grow.

Even if you leave in $10K–$20K, returns often still beat traditional investing.

🧠 Pro Tips

✅ Use detailed scopes of work with before/after photos to boost appraisal

✅ Get pre-approved with a lender that supports cash-out refis on recent rehabs

✅ Be realistic with ARV projections

✅ Always keep reserves—cash-out ≠ spending spree

📍 Final Thought

The BRRRR method is more than a tactic—it’s a repeatable wealth-building system. With smart buying, disciplined rehab, and strategic financing, you can grow your rental empire without constantly raising new capital

🏡 House of the Week – Expansive Luxury Estate on 9 Private Acres

📍 6030 Deer Run Drive, Hunting Valley, OH 44022

💰 Price: $2,495,000

📏 Size: 7,000 sq. ft.

🏡 Built: 2007

🛏 Beds: 5 | 🛁 Baths: 4

🚗 Garage: 4-Car Attached Garage

🌳 Lot: 9.09 acres

🏫 School District: Orange City School District

🧘 Vibes: Tucked away in prestigious Hunting Valley, this stately estate offers privacy, scale, and sophistication. From grand entertaining spaces to peaceful wooded surroundings, every detail is elevated—think soaring ceilings, chef's kitchen, spa-style baths, and a seamless indoor-outdoor flow. Perfect for those seeking nature, luxury, and lifestyle in one stunning package.

👉 Listed by: Adam Kaufman | Howard Hanna Real Estate Services

📞 216-831-7370 | ✉️ [email protected]

🛠 Tools & Resources We Recommend

PropStream → Lead generation + property comps

AirDNA → Short-term rental profitability data

BiggerPockets Cap Rate Guide → Know how to calculate investment ROI

Cleveland Housing Court Tracker → Spot eviction risks and distressed deals

Cleveland Real Estate Investor Facebook Group → Share deals and insights with local investors

📣 Weekly Wrap-Up

Buyers are finally gaining ground. With distressed property listings rising and seller competition softening, Cleveland's real estate market is setting up smart investors for long-term wins.

📈 Market Momentum:

Active inventory nationwide is up 28.9% year-over-year, while price growth has nearly flatlined at just +0.2%. In the Midwest, including Cleveland, prices have even dipped—creating prime negotiation leverage for buyers with strong financing.

🏗️ Development Watch:

Cleveland continues to push for affordability and livability. The city is now evaluating modular housing finalists to speed up development timelines, and its major 50-acre downtown lakefront plan is drawing national attention—with no stadium distractions this time.

🏘️ Neighborhood Highlight:

Investors are still finding cash flow in Cleveland’s under-the-radar gems. A duplex at 3602 Woodbridge Ave sold for $147,500—featuring ten rooms across two units in the Clark-Fulton/Old Brooklyn corridor. Rents are holding strong, and these zones are heating up.

💼 Sheriff Sale Strategy with Tyler Finkler:

Distress = opportunity. With more foreclosures hitting the market, Tyler Finkler helps buyers move quickly, avoid title traps, and tap hidden equity in Cleveland’s most active sheriff sale zones. Now’s the time to act while others wait.

🌟 Luxury Hit of the Week:

300 Woodridge Lane, Moreland Hills — A standout in Moreland Commons, this first-ever resale is listed at $1.85M. Featuring 6 beds, 5 baths, over 4,500+ sq ft above grade, and lifestyle extras like a bourbon tasting room and firepit patio, it’s turnkey elegance with room to entertain.

🧠 Investor Takeaway:

Cleveland is shifting. Inventory is up, urgency is down, and informed buyers are stepping in. Whether it’s luxury flips, BRRRRs, or sheriff sale plays—this market rewards preparation and patience.

Until next week,

Cleveland Real Estate Investors

📩 Don’t keep us a secret: Share the email with friends Forward the newsletter.

Reply