- Cleveland Real Estate Investors

- Posts

- 🏘️ Cleveland Rents Drop 8% — What It Means for 2026

🏘️ Cleveland Rents Drop 8% — What It Means for 2026

📉 Big Office Asset Hits the Block in Northeast Ohio

Good morning, Cleveland Real Estate Investors!

Don’t keep us a secret: Share the email with friends (copy URL here)

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

📬 In today’s edition:

🏦 Is Housing Demand Poised for a 2026 Comeback?

💡 Cleveland Remains a Renter-Friendly Market

🏢 Office Repricing Continues in Cleveland Region

📰 Cleveland Market Minute

Cleveland Rental Market Sees Dip in Costs

Historically, Cleveland has maintained its status as a cornerstone of Midwestern affordability, providing a budget-friendly alternative to the skyrocketing housing costs found in other major U.S. metros.

By December 2025, this trend of accessibility has solidified further, with the median rent settling at $1,200—a notable 8% decrease over the previous year. While nearby suburbs like University Heights see prices climb as high as $1,900, Cleveland’s market remains significantly below the national average, offering a stable environment for the 58% of the city's households who choose to rent.

Mortgage Rates Edge Toward Stability at Year-End

In late 2024, prospective homeowners faced a daunting market with 30-year mortgage rates averaging 6.85%, offering little hope for those seeking an affordable path to homeownership.

Instead, much of 2025 was defined by high entry costs and a sidelined buyer pool. But now, as the year draws to a close, the market is showing signs of stabilization, with the average long-term mortgage rate ticking down to 6.18%—nearly its lowest level in over a year.

While affordability remains a challenge for first-time buyers, industry experts hope that this period of steadying rates, combined with an increase in home listings, will finally reinvigorate the housing market as it moves into 2026.

Progressive HQ goes to auction

One of Northeast Ohio’s largest for-sale office properties will soon be put up for bid. Progressive Insurance’s first headquarters campus it constructed in the eastern suburbs is scheduled for a Feb. 2, 2026 auction.

This turn of events is the result of the property, called Campus One, being on the market for nearly two years and not selling.

📍 1951 W 26th St APT 411, Cleveland, OH 44113

💰 Sale Price: $275,000

📏 Size: 1,260 sq. ft.

📅 Year Built: 2003

🛏 2 Beds | 🛁 2 Full Baths

🚗 1 Heated Garage Space + Storage Locker

🏫 School District: Cleveland Municipal School District

📝 Investor Takeaway

This top-floor condo in the iconic Fries & Schuele Building showcases why Ohio City continues to command strong buyer demand. With sweeping skyline and West Side Market views, an open-concept layout, and modern finishes, the unit balances lifestyle appeal with solid fundamentals.

At ~$218 per square foot and an estimated rent of $2,511/month, the numbers support both owner-occupant value and long-term hold potential. Recent capital improvements to major building systems (roof and mechanical updates since 2024) reduce near-term maintenance risk—an important factor for condo investors.

Walkability, transit access, and proximity to dining and entertainment anchor this asset firmly within one of Cleveland’s most resilient urban submarkets.

🏡 Neighborhood Insight

📍 Community: Ohio City / Hingetown

🏞 Nearby Landmarks: West Side Market, Hingetown, Downtown Cleveland, Flats East Bank, Lakefront

🚶 Accessibility: Steps to dining, shopping, public transit, and major employment corridors

📈 Recent Sales Nearby:

1951 W 26th St APT 315 – $255,000 | 2 Bed | 2 Bath | 1.2k sq. ft.

1951 W 26th St APT 410 – $270,800 | 2 Bed | 2 Bath | 1.2k sq. ft.

2222 Detroit Ave APT 811 – $240,000 | 2 Bed | 2 Bath | 1.2k sq. ft.

1237 Center St #1101 – $305,000 | 2 Bed | 2 Bath | 1.2k sq. ft.

📌 Notable Features

✨ Panoramic skyline & West Side Market views

🔥 Gas fireplace in open living area

🪵 Hardwood floors & soaring ceilings

🍽 Island kitchen with granite & stainless steel appliances

🧖 Primary suite with glass-enclosed steam shower

🧺 In-unit laundry

🛗 Elevator access & handicap-accessible design

🏙 One of Cleveland’s most walkable urban neighborhoods

💡 Insider’s Insight

🏠 Housing Affordability Spotlight | December 2025

💰 The Salary Needed to Buy a Home — America’s Most Affordable Cities

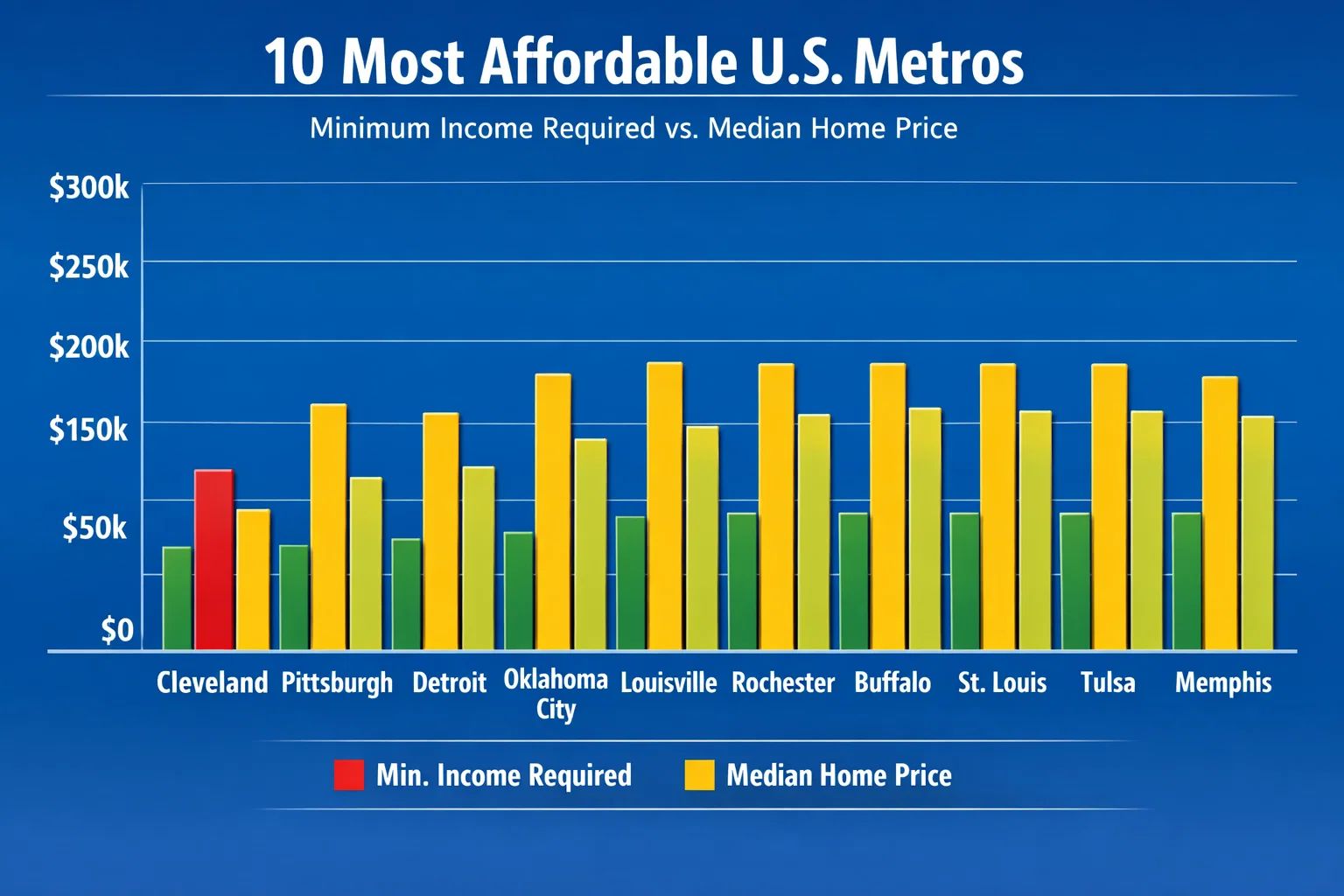

Homebuyers in the nation’s least expensive metros need far lower household incomes to afford a home—often under $85,000 annually, according to new Realtor.com housing data.

Most of these metros are located in the Midwest and parts of the South, where abundant land, steady construction, and lower costs of living have helped keep prices from surging like coastal markets.

📊 Key Context

National median home price: $415,000

Income needed nationally: $110,000+

Affordable metros offer ownership access at ~70% less income

🥇 Top 3 Most Affordable Metros by Income Required

🥇 Pittsburgh, PA

Median Price: $245,000

Monthly Payment: $1,630

Minimum Income: $65,208

🥈 Cleveland, OH

Median Price: $250,000

Monthly Payment: $1,663

Minimum Income: $66,538

🥉 Detroit, MI

Median Price: $255,000

Monthly Payment: $1,697

Minimum Income: $67,869

🧠 Insight: In markets like Cleveland, Pittsburgh, and Detroit, middle-income households can still buy without extreme financial strain—even with mortgage rates above 6%.

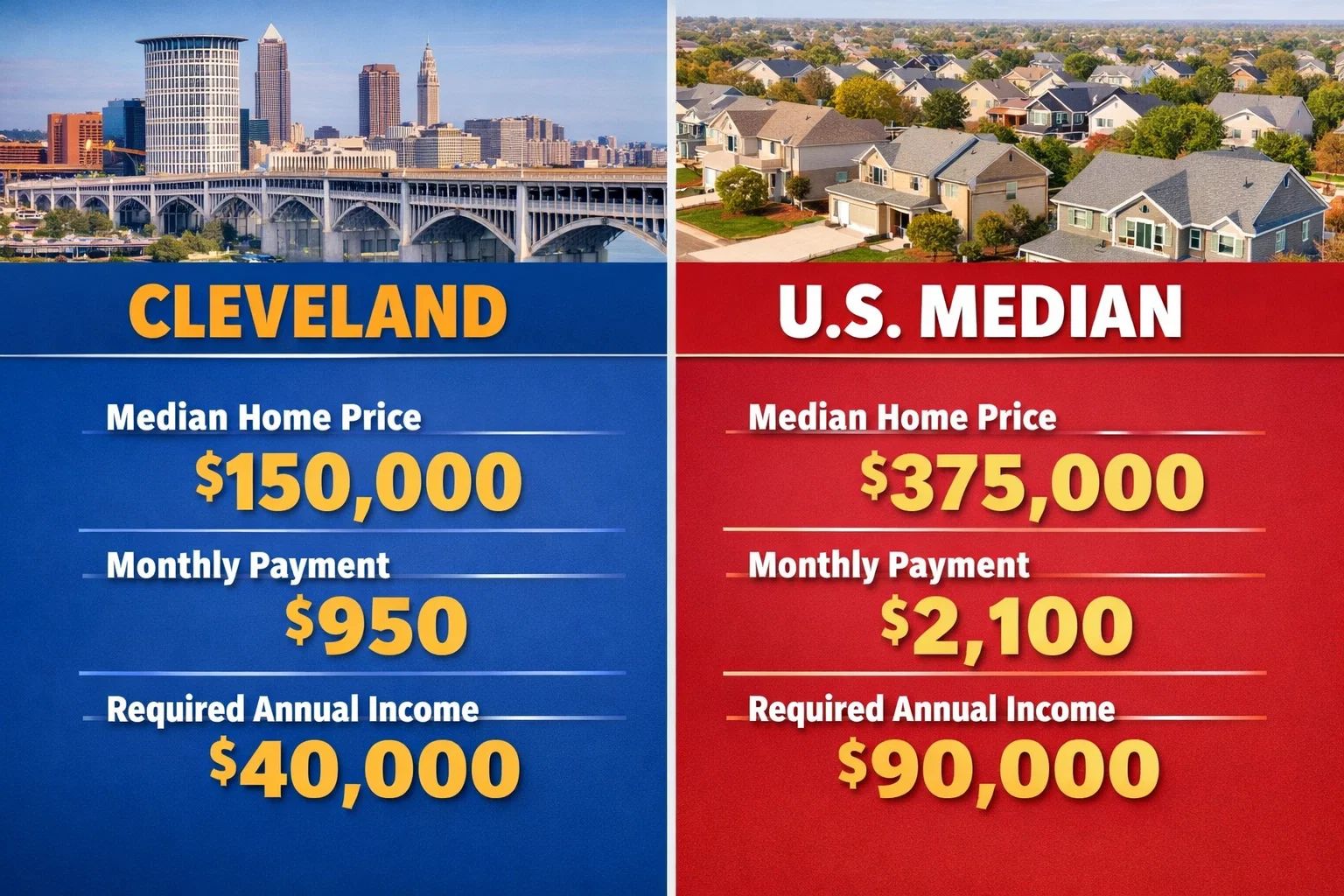

🏙️ Focus on Cleveland: Why It Stays Affordable

Cleveland ranks #2 nationally for lowest income required to buy a home.

📉 Affordability Breakdown

Typical Cleveland home costs $165,000 less than the national median

Average monthly payment: ~$1,660

Affordable on a household income of ~$66,500/year

🗣️ Market Perspective

Local real estate leadership attributes Cleveland’s affordability to:

Balanced price growth

Income levels aligned with housing costs

A wide mix of housing types across established and emerging neighborhoods

🏥 Lifestyle Advantage

Beyond pricing, Cleveland offers:

Diverse employment base

Strong healthcare and education institutions

Lower overall cost of living

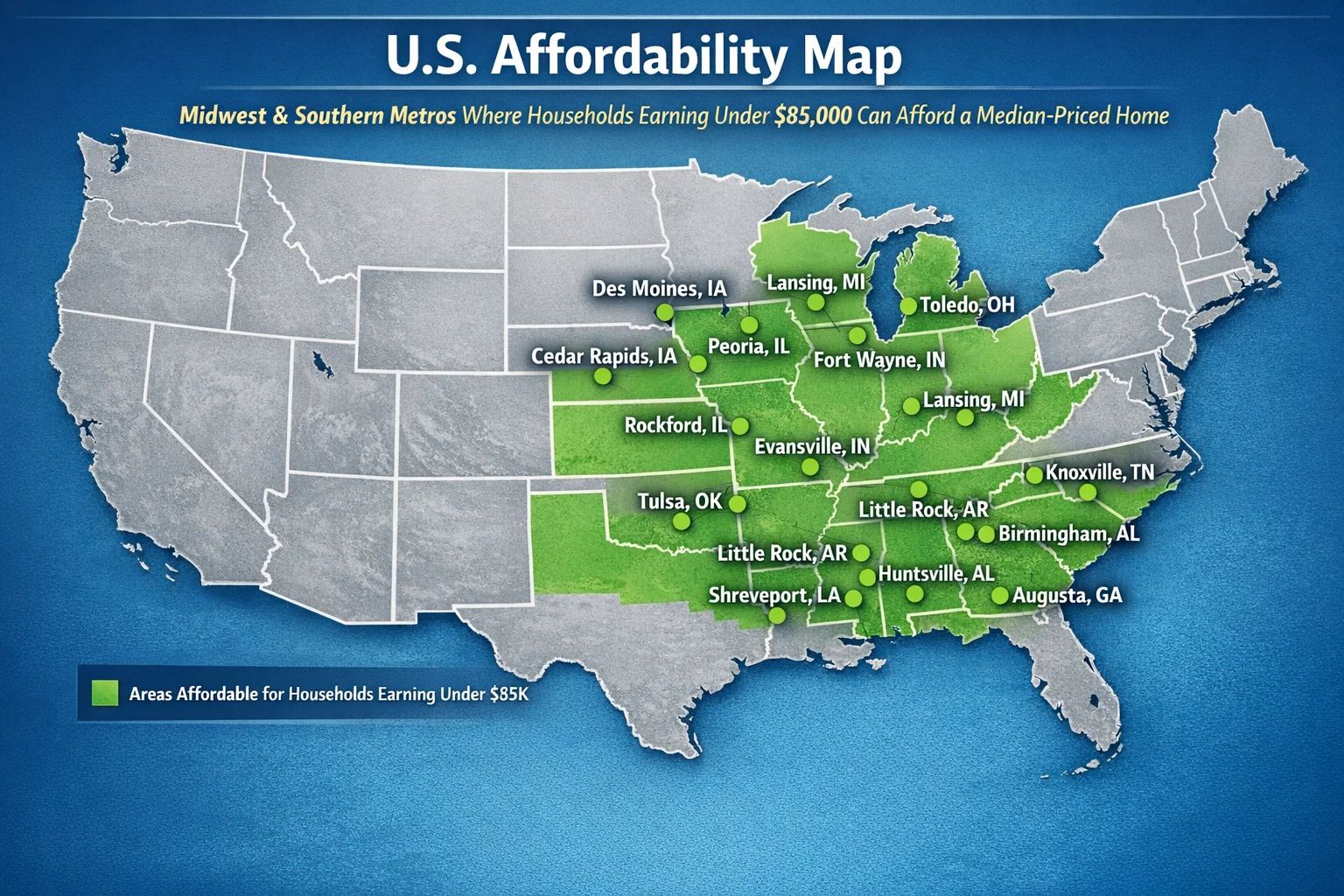

🌎 Geography of Affordability

Where you live dramatically changes what your income can buy.

🚫 High-Cost Metros

San Jose, Boston, NYC, Los Angeles

Constrained supply, strict zoning, high-income competition

✅ Affordable “Refuge” Markets

Cleveland, Pittsburgh, Detroit, St. Louis

Attracting remote workers, retirees, and relocators

📈 Trend Watch

Midwestern metros posted some of 2025’s strongest price gains, driven by in-migration—but remain affordable for locals.

📍 2222 Detroit Ave #503, Cleveland, OH 44113

💰 Price: $225,000

📏 Size: 1,138 sq ft

📅 Year Built: 2005

🛏 2 Beds | 🛁 2 Full Baths

🏢 High-Rise Condominium

🏫 School District: Cleveland Municipal School District

🧘 Vibes: Experience modern city living with iconic Cleveland scenery in this beautifully designed Stonebridge condo. The open-concept living, dining, and kitchen layout is wrapped in floor-to-ceiling windows showcasing stunning Detroit Bridge views, creating a bright, urban backdrop throughout the home.

Step outside to your private balcony, perfect for morning coffee, evening cocktails, or soaking in the city energy. The updated kitchen features light cabinetry, generous storage, a large island for entertaining, and a bold black subway tile backsplash, blending function with character. In-unit laundry adds everyday convenience, while the two-bedroom, two-bath layout offers flexibility for guests, work-from-home space, or shared living.

Residents enjoy concierge service, an on-site fitness center, and a stylish resident lounge, all just steps from top restaurants, entertainment, and cultural hotspots, with easy highway and public transit access. With exterior renovations currently underway, this home delivers both lifestyle appeal and added long-term value.

👉 Listed by: Tera Somogyi | Keller Williams Living

📞 561-901-9331 | ✉️ [email protected]

🛠 Tools & Resources We Recommend

PropStream → Lead generation + property comps

AirDNA → Short-term rental profitability data

BiggerPockets Cap Rate Guide → Know how to calculate investment ROI

Cleveland Housing Court Tracker → Spot eviction risks and distressed deals

Cleveland Real Estate Investor Facebook Group → Share deals and insights with local investors

📣 Weekly Wrap-Up

📉 Cleveland Rents Cool While Remaining a Midwest Standout

Cleveland continues to reinforce its reputation as one of the nation’s most affordable major metros. By December 2025, median rent declined to $1,200, down 8% year-over-year, even as nearby suburbs like University Heights push toward $1,900. With 58% of households renting, the city remains well-positioned for stable, long-term rental demand despite modest price softening.

🏦 Mortgage Rates Show Signs of Stabilizing

After much of 2025 sidelined buyers with elevated borrowing costs, mortgage rates are showing late-year relief. The average 30-year rate has eased to 6.18%, near its lowest point in over a year. While affordability remains tight for first-time buyers, stabilizing rates and rising inventory could help unlock pent-up demand heading into 2026.

🧭 Insider’s Insight | Housing Affordability (Dec 2025)

Cleveland ranks #2 nationally for lowest income required to buy a home.

Median home price: ~$250,000

Estimated monthly payment: ~$1,660

Income needed: ~$66,500/year

Compared to the national benchmark of $110K+ required income, Cleveland remains a rare market where middle-income households can still achieve homeownership—supporting long-term housing stability and migration interest.

🏠 Just Sold Spotlight – Ohio City Skyline Condo

📍 1951 W 26th St APT 411, Cleveland, OH 44113

💰 $275,000 | 2 Beds | 2 Baths | 1,260 sq. ft. | Built 2003

A top-floor condo in the Fries & Schuele Building with skyline and West Side Market views. At roughly $218/SF and estimated rents near $2,511/month, the asset supports both lifestyle appeal and durable hold potential in one of Cleveland’s most resilient urban submarkets.

🏡 House of the Week – Stonebridge Condo

📍 2222 Detroit Ave #503, Cleveland, OH 44113

💰 $225,000 | 2 Beds | 2 Baths | 1,138 sq. ft. | Built 2005

A light-filled Stonebridge condo with iconic Detroit Bridge views, private balcony, and full-service amenities. Ongoing exterior upgrades add long-term value, while proximity to Downtown, The Flats, and transit makes this a strong option for owner-occupants or rental-focused investors.

Until next week,

Cleveland Real Estate Investors

📩 Don’t keep us a secret: Share the email with friends Forward the newsletter.

Reply